ABOUT US

Discover 2EZBizCredit: Your Trusted Partner in Business Funding and Credit Solutions

Dedicated to Excellence and Service

We are on a mission to empower entrepreneurs, inspiring them to achieve their most significant business goals with proper funding. We help business owners find the credit, capital, and support needed to establish and grow a thriving business.

Get access to up to $150k in business credit lines, Traditional Financing such as SBA Financing, and the widest selection of Alternative Business Lending products. Plus we empower your growth with coaching, motivation and accountability, and a community of like-minded business owners. We go beyond just financing – we give you the tools and support needed to take your business to the next level. Let’s work together to fund your dreams a reality.

Our Key Features

Professional Coaching, Tailored Funding Plans, and Anytime Online Access

Live Expert Coaching and Support: Get personalized guidance from our experienced coaches.

Personalized Funding Strategy: Develop a tailored plan to secure the best funding options.

24/7 Online Access: Manage your funding and business credit needs anytime, anywhere.

-- Our Blog --

The 4 Cs of Business Lending for Trucking Professionals

The 4 Cs of Business Lending for Trucking Professionals

Securing business funding can sometimes feel overwhelming when you're an independent contractor, owner-operator, or fleet owner. However, gaining a deep understanding of the four Cs of business lending—Cash Flow, Collateral, Business Credit, and Personal Credit—can empower you and make the process much more manageable.

These are the key factors lenders look for when deciding if you qualify for a loan. The good news is that you only need one of these to get approval for most business financing.

1. Cash Flow: The Power of Strong Revenue

If your business is already generating consistent income, lenders will take that as a vital sign that you can manage and repay loans. Verifiable cash flow increases your chances of qualifying for Business Revenue Lending, a type of loan that is specifically designed for businesses with strong revenue. For truckers, consistent freight-hauling contracts can serve as proof of stable income. If you're hauling regularly, your cash flow is likely one of your greatest assets.

2. Collateral: What You Own Can Secure Funding

Do you need consistent cash flow? No problem. The following C is Collateral, which refers to your business assets. For fleet owners, this could mean using your trucks, equipment, or even outstanding invoices as collateral. Having physical assets, like trucks, significantly boosts your chances of loan approval. Collateral provides lenders with security, which could help you get funding with better terms.

3. Business Credit: Separate from Personal Credit

Lenders also look at your Business Credit profile to assess your fundability. A strong business credit score not only makes a huge difference but also provides a sense of security, allowing you to borrow without relying on personal guarantees. If your company has a good track record of managing credit, you're in an excellent position for funding. If not, now is the time to start building it. Business credit is a game changer, offering independence from your personal financial history and a reassuring path to funding.

4. Personal Credit: When Business Credit Isn't Enough

If you're starting or don't have strong cash flow, collateral, or business credit, lenders will use your credit to determine your eligibility. For many independent contractors and owner-operators, this is the fallback option. However, unsecured lines of credit are also available that rely solely on your credit score, meaning no collateral or revenue is required. This flexibility can be an excellent route for those new to the industry or looking to scale their operations, opening up new possibilities for funding.

No matter which C you have in your favor, there's likely a lending option available for you. The key is to know where your business stands about these factors and find the best route forward.😊

#2ezbizcredit #BlueDiamondBusinessSolutions #TruckersBusinessCredit #FleetOwnerFinancing #BusinessFundingForTruckers #OwnerOperatorLending #TruckDriversCredit #SmallBusinessLoans #BusinessLending #IndependentContractorFinancing

Are you seeking the proper funding to keep your trucking business moving forward? Visit 2ezbizcredit.com today to discover your best financing options and keep your fleet running strong!🚀

Contact Details:

Website: www.2ezbizcredit.com

Email: [email protected]

Phone: (833)-995-2110

Address: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Social Media:

Facebook: 2ezbizcredit Facebook

LinkedIn: 2ezbizcredit LinkedIn

Latest News & Article

-- YouTube Videos --

What's Happening: Upcoming Events

Get In Touch

Assistance Hours

Mon – Fri 8:00am – 5:00pm CST

Sat & Sun – CLOSED

Phone Number:

833-995-2110

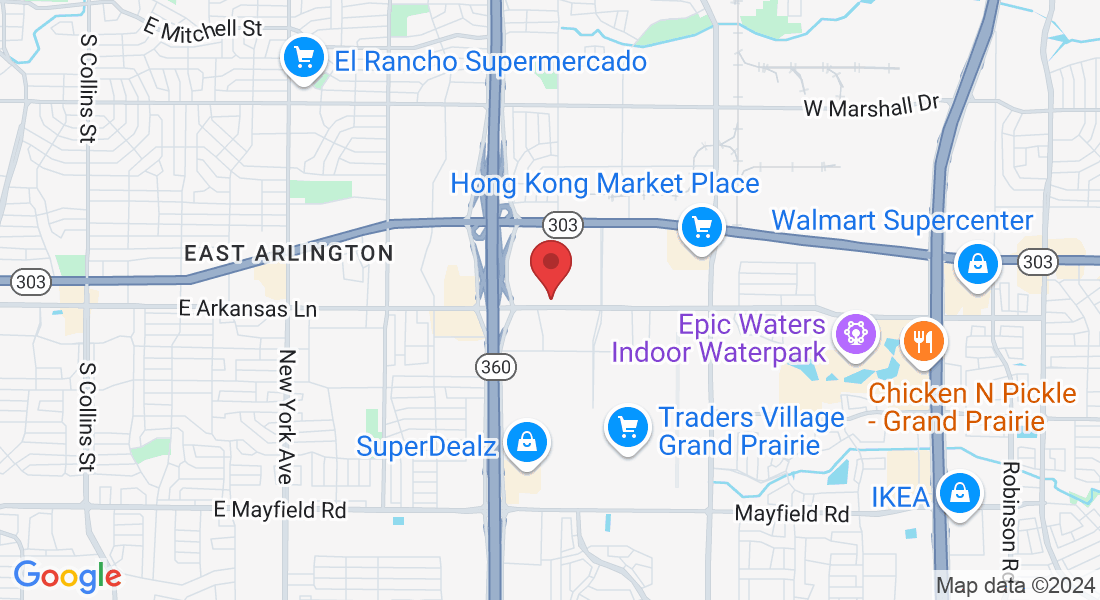

Post Address and Mail

Email: [email protected]

Address

Office: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Testimonials

Don't take our words for it, Hear from our clients

George O.

2ezbizcredit transformed our financing approach. With their expert guidance, we secured the funding needed to grow.”

Leon D.

Their business credit builder program is phenomenal. We now have access to significant credit lines without personal guarantees.

Michael T.

Exceptional service! Their team helped us navigate the complex world of business loans, and we got the best rates

Sarah W.

Thanks to 2ezbizcredit, we secured equipment financing seamlessly. Our business is thriving!

© 2024 2ezbizcredit - All Rights Reserved. 2ezbizcredit® is a trademarked brand. Unauthorized use is prohibited. Information on this site is for informational purposes only and does not constitute financial, legal, or professional advice.

By using our services, you agree to our Terms of Service and Privacy Policy. Contact our support team for questions.