ABOUT US

Discover 2EZBizCredit: Your Trusted Partner in Business Funding and Credit Solutions

Dedicated to Excellence and Service

We are on a mission to empower entrepreneurs, inspiring them to achieve their most significant business goals with proper funding. We help business owners find the credit, capital, and support needed to establish and grow a thriving business.

Get access to up to $150k in business credit lines, Traditional Financing such as SBA Financing, and the widest selection of Alternative Business Lending products. Plus we empower your growth with coaching, motivation and accountability, and a community of like-minded business owners. We go beyond just financing – we give you the tools and support needed to take your business to the next level. Let’s work together to fund your dreams a reality.

Our Key Features

Professional Coaching, Tailored Funding Plans, and Anytime Online Access

Live Expert Coaching and Support: Get personalized guidance from our experienced coaches.

Personalized Funding Strategy: Develop a tailored plan to secure the best funding options.

24/7 Online Access: Manage your funding and business credit needs anytime, anywhere.

-- Our Blog --

5 Factors That Affect Your Business Credit

"The more I practice, the luckier I get." - Gary Player

Introduction:

What makes up your business credit score? What gives you the best chance of getting a loan?

Here are a few factors that play into your business credit picture and how you can make the most of them:

5 Factors That Affect Your Business Credit:

1. Payment History: Your business credit profile is significantly influenced by this aspect, serving as the foundation of your D&B PAYDEX score. Vendors assess your entire credit situation, with your PAYDEX being a crucial component. This underscores the importance of maintaining a positive payment history, putting you in the driver's seat of your credit profile.

2. Blanket UCC Filings: The sequence in which you acquire certain loans and the UCC filings that lenders make are crucial. Some lenders might file a blanket UCC filing, indicating their interest in ALL your assets. These filings take precedence over any subsequent ones, significantly limiting your ability to secure credit elsewhere. This highlights the need for caution and strategic planning in negotiating UCC filings to protect your credit options.

What you can do: plan your credit with care and negotiate UCC filings according to your needs. For example, if you need your office equipment to be excluded from a UCC filing to use as security for another loan, you can explain this in advance. That way, you can exclude those items from any blanket filings. Or get the loan or account with the more specific UCC filing first. Some experts recommend opening accounts with competing UCC filings at the same time. And negotiate the details with each party simultaneously.

4. Company Financials: With Dun & Bradstreet (D&B), a major credit reporting agency, ensuring your credit file's financials are up to date is essential. If they are, it could positively reflect on your company when the lender compares available data. You can update your financials on your credit reports. Make sure they reflect your current circumstances. And plan to update often.

5. Company Legal Structure: having an LLC or corporation versus a partnership can also affect business credit. Lenders are less likely to loan money to sole proprietorships and partnerships. They prefer corporations and limited liability companies. So, if you aren't incorporated, you should be. The advantages go far past your ability to get credit. Other factors affect your ability to get credit, like the amount of debt you already have and how heavily invested you are in your company.

#BusinessCredit #CreditManagement #CreditMyths #PersonalCredit #BusinessFinance #FinancialTips

#2ezbizcredit #BlueDiamondBusinessSolutions

Ready to take your startup to the next level? Visit 2ezbizcredit to discover how we can help you secure the funding you need without a personal guarantee. Get started today and unlock your business's true potential! 🚀

Contact Details:

Website: www.2ezbizcredit.com

Email: [email protected]

Phone: (833)-995-2110

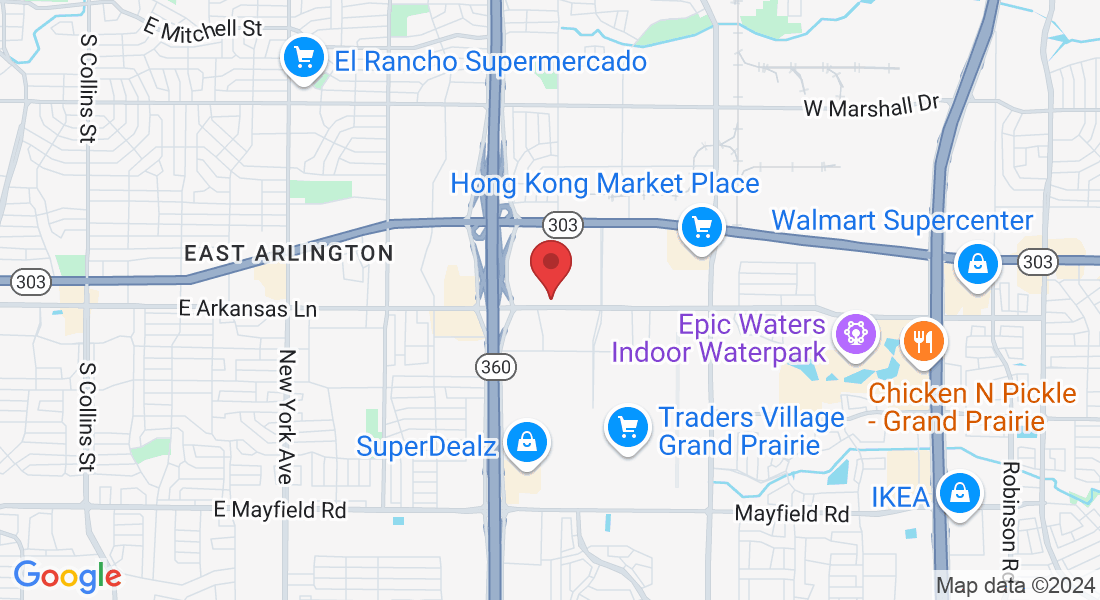

Address: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Social Media:

Facebook: 2ezbizcredit Facebook

LinkedIn: 2ezbizcredit LinkedIn

Twitter: 2ezbizcredit Twitter

Latest News & Article

-- YouTube Videos --

What's Happening: Upcoming Events

Get In Touch

Assistance Hours

Mon – Fri 8:00am – 5:00pm CST

Sat & Sun – CLOSED

Phone Number:

833-995-2110

Post Address and Mail

Email: [email protected]

Address

Office: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Testimonials

Don't take our words for it, Hear from our clients

George O.

2ezbizcredit transformed our financing approach. With their expert guidance, we secured the funding needed to grow.”

Leon D.

Their business credit builder program is phenomenal. We now have access to significant credit lines without personal guarantees.

Michael T.

Exceptional service! Their team helped us navigate the complex world of business loans, and we got the best rates

Sarah W.

Thanks to 2ezbizcredit, we secured equipment financing seamlessly. Our business is thriving!

© 2024 2ezbizcredit - All Rights Reserved. 2ezbizcredit® is a trademarked brand. Unauthorized use is prohibited. Information on this site is for informational purposes only and does not constitute financial, legal, or professional advice.

By using our services, you agree to our Terms of Service and Privacy Policy. Contact our support team for questions.