ABOUT US

Discover 2EZBizCredit: Your Trusted Partner in Business Funding and Credit Solutions

Dedicated to Excellence and Service

We are on a mission to empower entrepreneurs, inspiring them to achieve their most significant business goals with proper funding. We help business owners find the credit, capital, and support needed to establish and grow a thriving business.

Get access to up to $150k in business credit lines, Traditional Financing such as SBA Financing, and the widest selection of Alternative Business Lending products. Plus we empower your growth with coaching, motivation and accountability, and a community of like-minded business owners. We go beyond just financing – we give you the tools and support needed to take your business to the next level. Let’s work together to fund your dreams a reality.

Our Key Features

Professional Coaching, Tailored Funding Plans, and Anytime Online Access

Live Expert Coaching and Support: Get personalized guidance from our experienced coaches.

Personalized Funding Strategy: Develop a tailored plan to secure the best funding options.

24/7 Online Access: Manage your funding and business credit needs anytime, anywhere.

-- Our Blog --

Three Business Credit Myths Debunked

"An investment in knowledge pays the best interest." - Benjamin Franklin

Introduction:

Many people need help understanding the consumer credit system, and I need help understanding the business credit system. Today, I'll cover some common business credit myths and explain what can be learned from them.

By understanding these methods, you can make informed financial decisions that align with your business goals, feeling confident and in control of your business's financial future.

Three Business Credit Myths Debunked

Myth #1: Business Credit is Just Like Personal Credit This sounds like it should be accurate, but it isn't. Sure, the credit systems are similar. However, some significant differences can seriously affect your business. For starters, the consumer credit system has, both in court and in congressional testimony, been shown to be fairly anti-consumer. The system works against consumers often. It is prone to errors and tends to resist the correction of any errors by consumers or their advocates. In one example, even after a credit bureau lost in court, they continued to refuse for months to remove incorrect information from the person's credit reports. The business credit system is different. It is not anti-business (or anti-consumer) and is less prone to errors. And when there are legitimate errors, correcting them tends to be more accessible.

Myth #2: It Doesn't Hurt to Use Personal Credit in Place of Business Credit This is a problematic way of thinking that can lead to big problems.

Using personal credit for business puts your credit at 4 © ️2023 Credit Suite, all rights reserved. No reproduction or use of any portion of the content or work or the entire work is permitted without the publisher's express written permission and authorization. However, the publisher of these materials routinely approves the reproduction or use of this work, in whole or in part. If you would like to use any portion of this material in a book, article, e-zine, newsletter, radio, television broadcast, podcast, or in any other seminar teleconference or other events or publications, please email or call the distributor of this guide—articles for Posting risk for the sake of your business. By doing so, you limit the resources available to you personally and to your business. The result could be disastrous.

Imagine when your business credit needs exceed your credit capacity. Then, it would help if you used your credit, and you can't because your business ties it up. No matter how you spin it, in the end, using your credit for business is a bad idea. Myth #3: Business Credit and Personal Credit Are Not Related. Using your credit for business use is a bad idea. But we can't 100% separate business credit and personal credit. Often, especially when starting with business credit, a company owner must provide a personal guarantee for the business credit loan or line of credit. When providing a personal guarantee, the company extending credit will not only check your business credit. They will check your personal credit history. While the business account won't appear on your credit report, the personal guarantee could eventually affect your credit if it fails to meet its obligations. Aim to avoid that scenario (and you can) with careful planning and intelligent use of business credit.

#BusinessCredit #CreditManagement #CreditMyths #PersonalCredit #BusinessFinance #FinancialTips

#2ezbizcredit #BlueDiamondBusinessSolutions

Ready to take your startup to the next level? Visit 2ezbizcredit to discover how we can help you secure the funding you need without a personal guarantee. Get started today and unlock your business's true potential! 🚀

Contact Details:

Website: www.2ezbizcredit.com

Email: [email protected]

Phone: (833)-995-2110

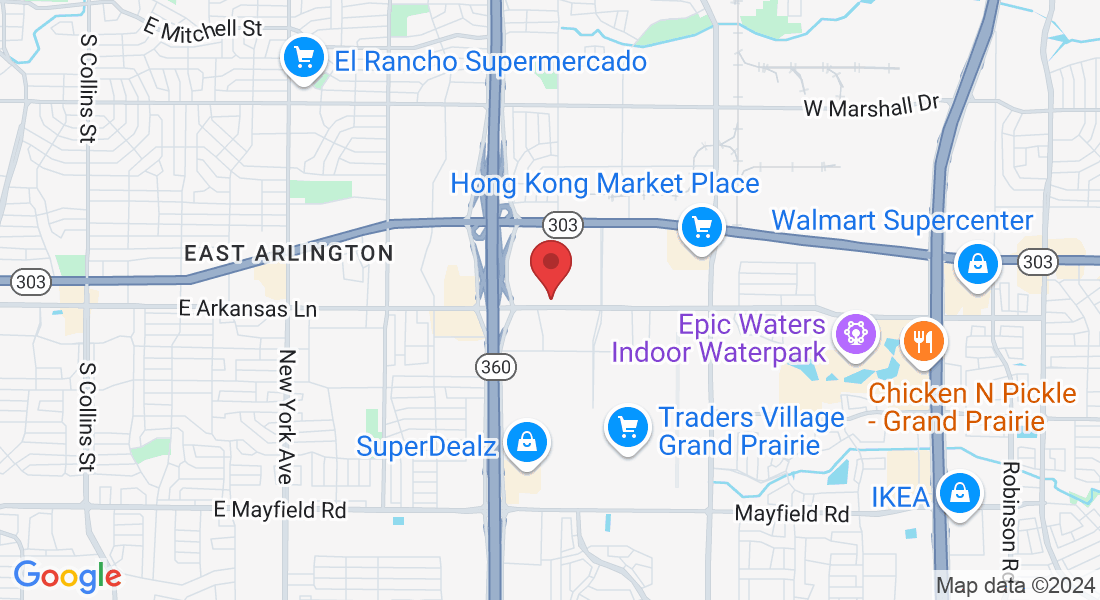

Address: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Social Media:

Facebook: 2ezbizcredit Facebook

LinkedIn: 2ezbizcredit LinkedIn

Twitter: 2ezbizcredit Twitter

Latest News & Article

-- YouTube Videos --

What's Happening: Upcoming Events

Get In Touch

Assistance Hours

Mon – Fri 8:00am – 5:00pm CST

Sat & Sun – CLOSED

Phone Number:

833-995-2110

Post Address and Mail

Email: [email protected]

Address

Office: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Testimonials

Don't take our words for it, Hear from our clients

George O.

2ezbizcredit transformed our financing approach. With their expert guidance, we secured the funding needed to grow.”

Leon D.

Their business credit builder program is phenomenal. We now have access to significant credit lines without personal guarantees.

Michael T.

Exceptional service! Their team helped us navigate the complex world of business loans, and we got the best rates

Sarah W.

Thanks to 2ezbizcredit, we secured equipment financing seamlessly. Our business is thriving!

© 2024 2ezbizcredit - All Rights Reserved. 2ezbizcredit® is a trademarked brand. Unauthorized use is prohibited. Information on this site is for informational purposes only and does not constitute financial, legal, or professional advice.

By using our services, you agree to our Terms of Service and Privacy Policy. Contact our support team for questions.