ABOUT US

Discover 2EZBizCredit: Your Trusted Partner in Business Funding and Credit Solutions

Dedicated to Excellence and Service

We are on a mission to empower entrepreneurs, inspiring them to achieve their most significant business goals with proper funding. We help business owners find the credit, capital, and support needed to establish and grow a thriving business.

Get access to up to $150k in business credit lines, Traditional Financing such as SBA Financing, and the widest selection of Alternative Business Lending products. Plus we empower your growth with coaching, motivation and accountability, and a community of like-minded business owners. We go beyond just financing – we give you the tools and support needed to take your business to the next level. Let’s work together to fund your dreams a reality.

Our Key Features

Professional Coaching, Tailored Funding Plans, and Anytime Online Access

Live Expert Coaching and Support: Get personalized guidance from our experienced coaches.

Personalized Funding Strategy: Develop a tailored plan to secure the best funding options.

24/7 Online Access: Manage your funding and business credit needs anytime, anywhere.

-- Our Blog --

9 Game-Changing Loan Options for Startups with Less-Than-Perfect Credit

"You don't need to be rich to start a business, but you need to start a business to become rich." - – Richard Branson

Introduction:

Starting a business is challenging, especially when securing the necessary funding. For startups with less-than-perfect credit, the traditional loan-securing routes can feel like an uphill battle. However, the power of business credit offers a way to unlock loans without needing a personal guarantee.

This article explores nine game-changing loan options for startups with limited or less-than-perfect credit, helping business owners understand the tradeoffs and challenges of each option.👊

1. Microloans for Startups

Microloans, typically offered by nonprofit organizations or community lenders, are a beacon of hope for startups with limited credit history. Ranging from $ 500 to $ 50,000, these loans offer easier approval processes, making them an ideal choice for such startups. However, it's crucial to balance the need for immediate funding with the potential long-term costs, such as higher interest rates.

2. Business Credit Cards

Business credit cards can be a strategic tool for startups needing to manage cash flow. They allow businesses to build credit while covering everyday expenses. However, it's important to use them strategically and pay off the balance monthly to avoid unnecessary debt, as high interest rates can quickly accumulate.

3. Equipment Financing

For startups needing to purchase machinery or technology, equipment financing is an excellent option. The equipment is collateral, making it easier to secure a loan even with less-than-perfect credit. However, this approach ties up capital in assets, limiting flexibility in other business areas.

4. Invoice Financing

Invoice financing allows startups to borrow against their outstanding invoices, providing immediate cash flow. While this option helps maintain liquidity, it can be costly as lenders may charge high fees for the service. Additionally, businesses must be prepared for the impact on customer relationships when a third-party lender becomes involved in collections.

5. Merchant Cash Advances

Merchant cash advances provide businesses with a lump sum of cash in exchange for a percentage of future sales. This option is appealing for startups with fluctuating revenue, but the cost of capital can be significantly higher than other forms of financing. It's crucial to weigh the ease of access against the potential financial strain.

6. Crowdfunding

Crowdfunding platforms like Kickstarter or GoFundMe allow startups to raise money from many small investors. This option provides access to funds without requiring credit checks or personal guarantees. However, the success of crowdfunding campaigns depends heavily on marketing efforts and public interest, which can be unpredictable.

7. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect startups with individual investors willing to fund their ventures. This alternative to traditional bank loans often comes with more flexible terms. However, the interest rates vary widely, and startups must present a compelling business case to attract investors.

8. Community Development Financial Institutions (CDFIs)

CDFIs are nonprofit organizations that provide financing to underserved communities. Startups with less-than-perfect credit may find CDFIs more willing to offer loans than traditional banks. The tradeoff is that CDFI loans may come with stricter terms and conditions, so it's essential to understand the full scope of the agreement.

9. SBA Loans

The U.S. Small Business Administration (SBA) offers loan programs to support small businesses. While SBA loans can be challenging to qualify for, they offer favorable terms and lower interest rates than other options. Startups with limited credit history should explore SBA microloans or the SBA 7(a) loan program, which offers more lenient requirements.

Balancing the Tradeoffs

Choosing the right loan option involves balancing various factors such as interest rates, repayment terms, and accessibility. Startups must carefully consider the long-term impact of each financing option, as some may offer quick access to funds but at a higher cost. Others may provide favorable terms but require more stringent qualifications.

The tradeoffs often come down to immediate needs versus long-term sustainability. Startups should assess their financial situation, growth potential, and the specific requirements of their industry before deciding on a funding option. It's essential to consider the availability of funds and the potential impact on cash flow, business operations, and credit health.

Conclusion

The power of business credit is undeniable when unlocking loans without a personal guarantee. By exploring alternative financing options, startups with less-than-perfect credit can still secure the funding needed to grow and succeed. However, it's crucial to carefully evaluate the tradeoffs involved in each option. This evaluation should always be guided by the long-term goals of the business, ensuring that the chosen path is aligned with these goals.

Ready to take your startup to the next level? Visit 2ezbizcredit to discover how we can help you secure the funding you need without a personal guarantee. Get started today and unlock your business's true potential! 🚀

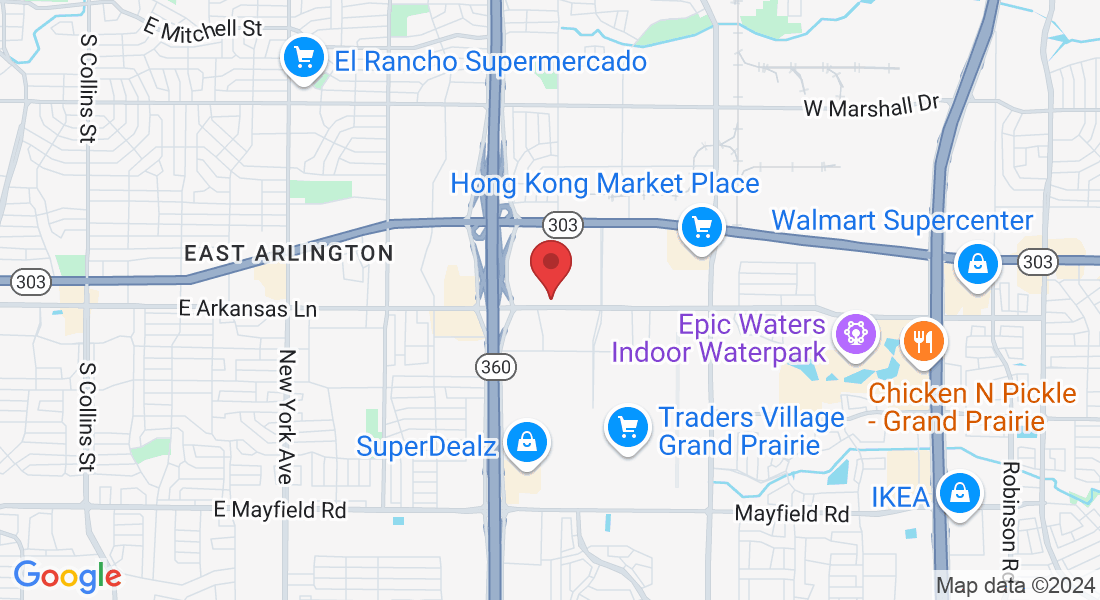

Contact Details:

Website: www.2ezbizcredit.com

Email: [email protected]

Phone: (833)-995-2110

Address: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Social Media:

Facebook: 2ezbizcredit Facebook

LinkedIn: 2ezbizcredit LinkedIn

Twitter: 2ezbizcredit Twitter

Latest News & Article

-- YouTube Videos --

What's Happening: Upcoming Events

Get In Touch

Assistance Hours

Mon – Fri 8:00am – 5:00pm CST

Sat & Sun – CLOSED

Phone Number:

833-995-2110

Post Address and Mail

Email: [email protected]

Address

Office: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Testimonials

Don't take our words for it, Hear from our clients

George O.

2ezbizcredit transformed our financing approach. With their expert guidance, we secured the funding needed to grow.”

Leon D.

Their business credit builder program is phenomenal. We now have access to significant credit lines without personal guarantees.

Michael T.

Exceptional service! Their team helped us navigate the complex world of business loans, and we got the best rates

Sarah W.

Thanks to 2ezbizcredit, we secured equipment financing seamlessly. Our business is thriving!

© 2024 2ezbizcredit - All Rights Reserved. 2ezbizcredit® is a trademarked brand. Unauthorized use is prohibited. Information on this site is for informational purposes only and does not constitute financial, legal, or professional advice.

By using our services, you agree to our Terms of Service and Privacy Policy. Contact our support team for questions.